What Does Family Insurance Solutions Mean?

What Does Family Insurance Solutions Mean?

Blog Article

Coverage protection is one of those things that we often ignore right until we really need it. It's the safety Internet that could catch us when daily life throws us a curveball. Irrespective of whether it's a sudden professional medical emergency, a vehicle incident, or harm to your own home, coverage safety makes sure that you're not left stranded. But, what exactly will it necessarily mean to get insurance plan defense? And how Are you aware of for anyone who is definitely coated? Let's dive into the world of insurance policy and investigate its a lot of aspects to assist you to realize why it's so essential.

More About Family Insurance Solutions

Very first, let’s look at what coverage defense truly is. It’s effectively a contract between you and an insurance provider that claims money support during the party of the decline, hurt, or personal injury. In exchange for just a month to month or yearly top quality, the insurance company agrees to go over sure challenges that you could experience. This security gives you comfort, understanding that In the event the worst occurs, you won’t bear all the monetary stress alone.

Very first, let’s look at what coverage defense truly is. It’s effectively a contract between you and an insurance provider that claims money support during the party of the decline, hurt, or personal injury. In exchange for just a month to month or yearly top quality, the insurance company agrees to go over sure challenges that you could experience. This security gives you comfort, understanding that In the event the worst occurs, you won’t bear all the monetary stress alone.Now, there's a chance you're pondering, "I’m healthier, I push cautiously, and my household is in good shape. Do I really need insurance policy protection?" The reality is, we could never forecast the future. Incidents materialize, ailment strikes, and purely natural disasters arise devoid of warning. Insurance coverage defense acts to be a safeguard towards these unexpected occasions, encouraging you manage expenses when factors go wrong. It’s an investment decision inside your long run well-becoming.

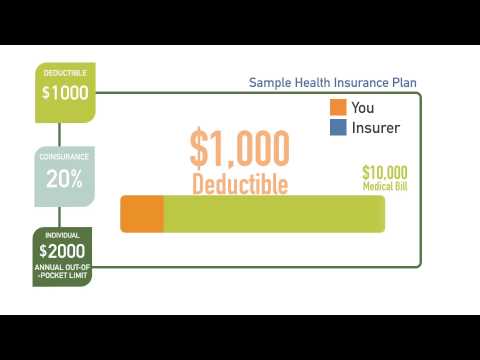

The most widespread varieties of insurance policies security is wellbeing insurance policies. It handles health-related expenditures, from regime checkups to unexpected emergency surgeries. Devoid of overall health insurance, even a short medical center remain could go away you with crippling medical expenses. Wellbeing insurance policy helps you to accessibility the care you will need without the need of worrying with regards to the financial strain. It’s a lifeline in moments of vulnerability.

Then, there’s car coverage, which is an additional necessary form of safety. Whether you might be driving a manufacturer-new car or an more mature design, accidents can happen Anytime. With car coverage, you're coated inside the party of a crash, theft, or harm to your auto. Moreover, if you're involved in an accident where you're at fault, your policy can help protect The prices for another party’s vehicle repairs and medical charges. In a way, vehicle insurance plan is sort of a shield guarding you from the consequences on the unpredictable road.

Homeowners’ insurance policies is yet another essential style of protection, especially if you personal your very own dwelling. This coverage guards your property from a range of threats, together with fireplace, theft, or organic disasters like floods or earthquakes. Without having it, you could possibly deal with economic ruin if your private home were being to get destroyed or seriously harmed. Homeowners’ insurance plan not just handles repairs, but also supplies liability security if a person is injured with your assets. It's a comprehensive protection Web for your property and almost everything in it.

Existence insurance plan is one particular place that often gets ignored, but it surely’s equally as significant. Whilst it’s not a thing we want to think about, life insurance policies makes certain that your loved ones are monetarily safeguarded if a little something have been to occur to you personally. It provides a payout for your beneficiaries, serving to them cover funeral costs, debts, or living costs. Daily life insurance policies is often a method of showing your family and friends that you choose to care, even When you're absent.

Another sort of insurance policies safety that’s turning into progressively popular is renters’ insurance. If you lease your home or condominium, your landlord’s insurance plan may possibly go over the developing itself, but it surely won’t go over your personal belongings. Renters’ insurance policy is pretty cost-effective and might shield your belongings in case of theft, hearth, or other unforeseen functions. It’s a little expenditure that could help you save from big financial decline.

Although we’re on The subject of insurance plan, let’s not ignore incapacity insurance policies. It’s one of several lesser-known sorts of defense, but it’s incredibly vital. Disability insurance coverage offers profits substitution if you develop into struggling to perform as a consequence of sickness or personal injury. It makes certain that you don’t drop your livelihood if anything unanticipated transpires, making it possible for you to definitely target Restoration with no stressing regarding your finances. For many who count on their own paycheck to create ends meet up with, incapacity coverage can be quite a lifesaver.

Now, Allow’s look at the significance of picking out the appropriate insurance coverage supplier. With lots of choices out there, it may be overwhelming to select the ideal 1 for you. When choosing an insurer, you need to make certain they provide the protection Explore the info you'll need at a price you can Get more insights pay for. It’s also essential to look at their track record, customer support, and the ease of filing promises. In spite of everything, you'd like an insurance provider that can have your back after you need it most.

But just getting insurance plan security isn’t plenty of. You furthermore may need to comprehend the conditions within your plan. Looking at the fine print may not be enjoyable, but it really’s crucial to learn what precisely’s lined and what isn’t. Ensure you Find more understand the deductibles, exclusions, and restrictions of one's coverage. By doing so, it is possible to prevent nasty surprises when you might want to file a assert. Awareness is power On the subject of insurance policies.

What Does Insurance For Entrepreneurs Do?

An additional factor to contemplate may be the potential for bundling your insurance coverage policies. Quite a few coverage firms provide discounts if you buy various kinds of insurance coverage as a result of them, for example dwelling and vehicle coverage. Bundling could help you save funds when ensuring that you've got extensive security in place. So, for those who’re now searching for a person kind of insurance policy, it would be really worth Checking out your choices for bundling.The principle of insurance coverage defense goes past private insurance policies in addition. Businesses have to have insurance coverage way too. Should you individual a business, you probably deal with hazards that will effect your organization’s fiscal health. Business enterprise insurance policies guards you from A variety of concerns, including house harm, authorized liabilities, and personnel-related risks. For instance, basic liability insurance may also help guard your online business if a client is injured with your premises. Getting company insurance plan provides the security to operate your company without continuously worrying about what may well go Incorrect.